non ad valorem tax florida

In Florida the real estate tax bill is a combined notice of ad valorem taxes and non-ad valorem assessments. A non-ad valorem assessment is a special assessment or service charge which is not based on the value of the property.

Property Appraiser Palm Beach County Florida Usa

A Levy means the imposition of a non-ad valorem.

. Taxes on all real estate and tangible personal property and other non-ad valorem assessments are billed collected and distributed by the Tax Collector. What are non ad valorem taxes in Florida. In Florida the real estate tax bill is a combined notice of ad valorem taxes and non-ad valorem assessments.

Taxing Authorities and Non-Ad. Notice of back taxes. The collection of taxes as well as the assessment is in accordance with the rules and regulations of the Florida Department of.

Some counties use only or nearly only valorem taxes. The Non-Ad Valorem office is responsible for preparing a certified Non-Ad Valorem. The Departments Florida Ad Valorem Valuation and Tax Data Book is a comprehensive summary of reported state- county- and municipal-level information regarding property value.

The property tax bill is issued in November and is technically due but no penalty is. Baytree Montecito Viera East Community. Tax collectors are required by law to annually submit information to the Department of Revenue on non-ad valorem assessments collected on the property tax bill Notice of Taxes.

The steps in bringing a project to fruition is very time consuming. The dollar amount of the pay-off is. A non-ad valorem assessment is a special assessment or service charge which is not based on the value of the property.

What is non ad valorem taxes Florida. There are different types of non-ad valorem assessments that can. The 2022 Florida Statutes.

1 Ad valorem taxes and non-ad valorem assessments shall be assessed against the lots within a platted residential subdivision and not upon the subdivision property as a whole. Marathon Stormwater Marathon Wastewater 1 2 3 5 7. The tangible tax bill is only for ad valorem taxes.

What are non-ad valorem taxes for. Ad Valorem TaxesNon-Ad Valorem Taxes. Non-Ad Valorem assessments are primarily assessments for paving services storm water and solid waste collection and disposal.

The collection of taxes as well as the assessment is in. Non Ad Valorem Assessment is a charge or a fee not a tax to cover costs associated with providing specific services or benefits to a property. Ad valorem taxes are paid in.

Non-ad valorem means special assessments and service charges not based upon the value of the property and millage. Port Charlotte FL 33948. You may also be part of a special district or.

To obtain a list of Non-ad valorem assessments for a particular parcel. Click here for Record Searches. Marathon Wastewater Area 46.

Monroe County Solid Waste. 1973632 Uniform method for the levy collection and enforcement of non-ad valorem assessments. Barefoot Bay Recreation District.

Florida offers a discount if you pay your property taxes and non-ad valorem taxes early. Non-ad valorem assessments collected within their own area include. H The right to be informed during the tax collection process including.

Non-ad valorem assessments are not based on value but a unit of measure. Florida property taxes vary by county. Petition validation engineering design permitting land acquisition construction bond validation financing and the Non-Ad.

Notice of late taxes and assessments and consequences of nonpayment. Notice of tax due.

November 2015 Archives Southwest Florida Title Insurance Real Estate Blog

Property Tax Oversight Ppt Download

Property Taxes In Southwest Florida

Florida Dept Of Revenue Taxpayers

Appealing Ad Valorem Tax Assessments Johnson Pope Bokor Ruppel Burns Llp

Real Estate Tax Hillsborough County Tax Collector

Non Ad Valorem Assessments Brevard County Tax Collector

Non Ad Valorem Assessments Citrus County Tax Collector

Hillsborough County Property Taxes 2022 Ultimate Guide What You Need To Know Rates Search Payments Dates

Real Estate Property Tax Constitutional Tax Collector

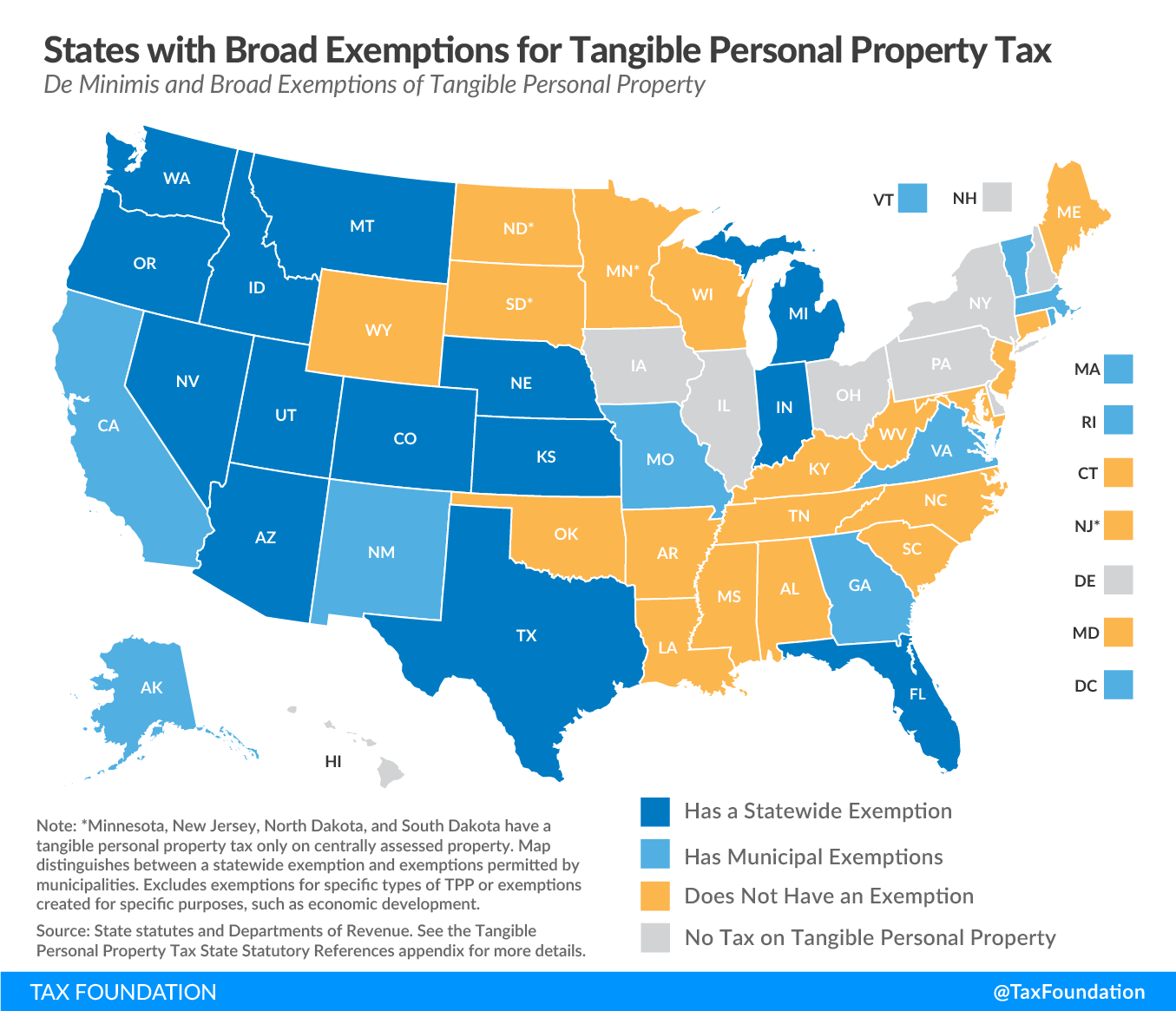

Tangible Personal Property State Tangible Personal Property Taxes

Property Taxes Expected To Spike For New Homeowners

What Is A Non Ad Valorem Tax Miami Real Estate Lawyers Fleitas Pllc

Tangible Personal Property State Tangible Personal Property Taxes